Sierra-Cedar (and its predecessor organizations)has conducted and published the results of its annual survey of HR information technology users for the last 22 consecutive years.

A few details stand out among the survey group demographics: 609 of 1,892 (32%) of the organizations are global with the average global organization having operations in 26 countries. Fully 77% of respondents were assigned to HR or Finance functions, and they had an average of three years in their current role. Fully 85% of respondents have a Bachelor’s degree or better (39% with a postgraduate degree) and 50% have at least one HR or IT professional certification.

Bob Greene, Co-Managing Editor of WSR, conducted an interview with Sierra-Cedar’s VP of Research and Analytics, Stacey Harris, with a focus on the most important trends and best practices gleaned from this year’s survey.

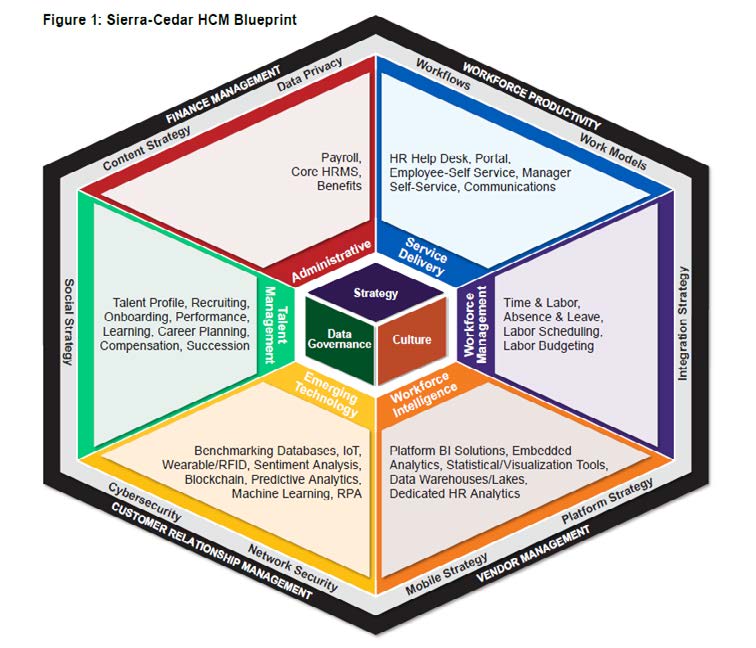

The Sierra-Cedar HCM Blueprint

Sierra-Cedar bases their survey on an HCM “blueprint” laying out something akin to a data entity relationship diagram, but focusing on business departments, processes and outcomes, rather than database content. This year’s blueprint (See Figure 1) offers a concentric set of object layers, with the highest level of guiding principles at its center (Strategy, Culture and Data Governance), and radiating outward to relate these principles to HR functions (Administration, Service Delivery, Workforce Management, Workforce Analytics, Emerging Technology and Talent Management), and finally to key business functions (Integration Strategy, Platform Strategy, Mobile Strategy, Network Strategy, Cybersecurity, Social Strategy, Content Strategy, Workflow, Work Models, and Data Privacy.)

Since this is the 22nd annual HR Systems Survey that Sierra-Cedar has conducted, WSR thought a good place to start would be to learn what new overall trends were revealed in this latest inquiry.

The most meaningful trend that Harris noted in the survey results this year was a clear transition from organizations measuring the success of HR information technology solutions by their production of process improvement value, to a focus instead on their impact on business outcomes. In the past, Harris reports, some organizations were satisfied to modernize HRMS platforms “for technology’s own sake,” to take advantage of available technology options because they were available, or simply to “keep up with the Joneses” (in this case, peer employers).

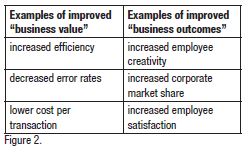

What Harris sees in these latest results is an increased focus on the impact of new technology on holistic business outcomes that extend far beyond the four walls of the HR Department. Indeed, in-depth drill down by the survey reveals that outcome-focused organizations generally see an average 15 percent higher return on investment on HR technology than business value-focused organizations. A simple comparative list of these objectives tends to prove the point:

While the examples of improved business values above tend to impact just the Human Resources and related departments, the examples of improved business outcomes tend to impact the entire organization.

Harris notes that this migration from organizations deploying HR technology to seek increased business value to, increasingly, seeking better business outcomes, has been a multi-year trend, but the most recent survey shows that this trend has come into its own, with a clear recognition on the part of the most forward-thinking companies that better business outcomes should be the

priority.

Finally, Harris points out, the issue of better business outcomes really focus on one key concept: the presence or absence of well thought-out strategies. The four types of strategies that most impact business outcomes, the survey points out, are HR systems strategy, integration strategy, the external perception of HR (which can be viewed as adding strategic value to multiple levels of management), and a strategy to develop and maintain a culture of change management.

A “Mini-Rorschach®” Test? What Type of Organization Are You?

The Sierra-Cedar Survey focuses significant investment on categorizing responding organizations into one of four organizational types: (a.) talent-driven, (b.) emerging technology driven, (c.) data-driven, and (d.) social responsibility- driven.

Categorization of organizations into these four business models is largely made based on their approaches to decision making:

- Talent driven organizations make decisions based on talent, and are typified by:

- Mature career planning

- Succession management

- Metric based outcomes such as employee engagement, retention risks and care for top talent.

- Emerging technology driven organizations make decisions based largely on technology, and are typified by:

- Mobile enabled HR

- Social platform enabled HR

- Use of intelligent technologies.

- Data driven organizations make decisions based on data, and are typified by:

- Mature workforce analytics

- Regular use of three or more metrics…

- …with data originating from 3 or more data sources.

- Socially responsible organizations make decision focused on social responsibility, and are typified by concerns for:

- Diversity and inclusion

- Family leave

- Flexible schedules

- Wellness.

The survey makes the point that this categorization is useful because different organizations can take different routes to achieving better business outcomes. Social responsibility, in particular, is a relatively new category, making its debut in the survey just three years ago. But in that short time, it has truly come into its own. Indeed, readers may remember that in August of 2019, the highly respected Business Roundtable, an assemblage of almost 200 CEOs of some of the largest companies in the U.S. and around the world, issued a statement1 revising their definition of the “purpose of the corporation” to include more aspects of social responsibility, including an increased focus on employee welfare.

Data Footprint Strategy, You Ask?

What Data Footprint Strategy?

Harris reported that one of the most surprising findings in this year’s survey was revealed in answers to questions around an organization’s employee data footprint strategy – how it’s collected, who owns each element, ensuring continuous cleansing, and controlling the data’s use.

Amazingly, only about 12 percent of organizations had an established organizational strategy around the employee data footprint, and Harris reports that a surprising 42 percent responded that they simply didn’t know whether their organizations have an employee data strategy or not. Since one of the primary elements of an employee data strategy ought to be data privacy and protection of personally identifiable information, this was a disturbing finding, given that we are almost two years beyond the initial effective date of the European Union’s General Data Protection Regulation (“GDPR,” effective May, 2018), and employers with California based employees are newly subject to the rules of the California Consumer Privacy Act (“CCPA”, effective January 1, 2020).

Asked for more definition of the kind of data utilization project that benefits most from a well-defined employee data footprint strategy, Harris cited the example of an innovative (some might call it “bleeding edge”) study conducted by a European-based organization called Synergy Sky, in which the researchers collected data from various organizations’ individual employee calendars to analyze the many ways that those employees “carve themselves out” reserved time. (See the very recent blog: “Have you ever booked a fake meeting to appear busier at work? Our study shows that at least 10% of workers have!”)2 The resulting research report is an interesting read, but regardless of the reader’s view of whether this is a looming problem in their own working environment or not, the subject matter and data collection methodology forms a good example of the reason why organizations need a well-designed and clearly communicated data footprint strategy. Thinking about the methods used in the “fake meetings” research described above, there are data privacy issues (“I didn’t know you could harvest that data from my calendar…”) to unified platform questions (Is everyone on the same calendar software?) to recordkeeping practices (each department has its own way of recording virtual and in person meeting commitments).

The SaaS vs. On Premise Debate: Is It Over?

One of the mainstays of the Sierra-Cedar HR Systems Survey in recent years has been a series of questions around deployment models: on-premise vs. software a sa service, and suite/unified platform vs. best of breed, and of course, drilling down on this data by applications area (HR, payroll, talent management, and workforce management). Harris reports that from the data collected this year, it is clear that organizations that have planned to migrate from on-premise to SaaS, or in-house written to packaged solutions, have largely done so. The “plateau” in this regard appears to be about 70 percent of applications in the Cloud. The reasons for 30 percent remaining on-premise, Harris tells us, are many and varied, including archive databases of past year employment history, one-off solutions in smaller limited deployments (like in-country localizations not supported by a primary SaaS vendor), or point solutions that have been customized to a point that they cannot be migrated to off-the-shelf solutions.

Where We Go From Here: Integrations,

Marketplaces and the “iPhone Effect”

The questions and data collected in the Survey around single vendor platform and suites, vs. multi-vendor approaches and best of breed, brought Harris to her final area of best practice trending that is of great interest, and it implicates the near-term future of Human Capital Management infrastructure.

Harris notes a growing trend of HCM vendors not only becoming more “integration friendly,” but for them to go further and “lay out the welcome mat” for their partners and their customers to do business via marketplaces and virtual partner showrooms. Originally rolled out by the bigger name ERP vendors, but now extending to the most recognizable names in HCM standalone, these marketplaces allow a user to enjoy multiple benefits from “certified” partner technologies – from allowing the customer to vet the software online, to allowing them to try before they buy, to possibly purchasing the subscription right through a reseller portal on the main HCM vendor’s website. Depending on the complexity of the solution and its configuration options, it might even “self-install” through the same experience.

Obviously, the advent and maturation of web service integration programming techniques and the technology that supports them made this approach feasible. But an equally important change occurred in the boardrooms of these vendors, for two reasons: (a) software executives increasingly came to the realization that they could still see great business success if they strategically give certain functions away to preferred partners, because they can’t be “all things to all people”, and (b) the iTunes, Android and Google platforms – almost entirely B2C in their apps focus, gradually established an expectation on the part of users of B2B software that they should be able to enjoy the same level of interoperability of separate but related software components that’s available in their hand held device.

Finally, Harris points out two specific changes in the way that HCM solutions are bought and sold as a consequence of this fundamental shift in product design: (a) the inevitable increase in commoditization of the solutions themselves, and (b) a change in focus for HCM solution evaluation.

HCM vendors have been facing an unhappy trend in recent years: the commoditization of their solutions. Simply put, from a purely functional perspective, and given the aggressive product development in the HR software industry, each year it gets harder and harder for HCM providers to make their solutions stand out functionally. Most experts saw this first in areas like Payroll, then basic HRMS, and we are now reaching parity for many of the available solutions in the workforce management and talent management spaces.

When a group of vendors and solutions being evaluated are all deemed by the customer to be extremely similar in capability, decisions may end up being made on price, financial terms, and service levels – NOT on core capabilities, and that is obviously not what the solutions vendors would prefer.

At the same time that functionality is being largely commoditized, however, other capabilities essential to support the marketplaces and “microservices” Harris speaks of begin to take greater precedence in systems evaluations. These include, for core HRMS, Payroll, Talent and Workforce solutions:

- The ability to integrate via standard programming techniques, avoiding proprietary methods

- The availability of multiple, competitive micro-solutions in a single domain area, perhaps differentiated by price or employer size “sweet spot”

- “TRUE” microservice integration, preferably “plug-and-play;” the days when joint marketing agreements were all that was delivered in product partnerships are SO over!

- A radical level of due diligence on the part of the vendor hosting the marketplace, to protect current and future customers.

No HCM vendor wants to be in the position of discovering that a software partner’s code has been hacked, or that their Payroll partner was involved in a financial scandal involving client funds.

The 22nd Annual Sierra Cedar HR Systems Survey is a must read for organizations serious about developing and optimizing their Human Capital Management strategies. The soft copy of the full report weighs in at 138 pages or so, but there is great information on every page. The best news is that it is free to all; you can go here to download it.

About the Interviewee

About the Interviewee

Stacey Harris is the VP of Research and Analytics at Sierra-Cedar where she oversees their industry research work, including the esteemed Annual HR Systems Survey and White Paper, now in its 22nd year. Stacey was recently listed in HR Examiners 2019 Top 100 HR Tech Influencers list and she also sits on the IHRIM Board of Directors, overseeing strategy and education in her role as Vice Chair. A former executive with HR research firms Bersin & Associates by Deloitte and Brandon Hall, she is a frequent speaker at HR events both in the U.S. and abroad, and often quoted in major media outlets such as Forbes, Fast-Company, and HR Executive magazines. Prior to joining the research community, Harris obtained her Master’s in Education, worked as a practitioner and consultant, and advised on multiple HR, Talent Management, and Learning initiatives for fortune 100 organizations around the world. Every Thursday morning, you can also find Stacey co-hosting the popular HR Tech Weekly Radio Show at HR Examiner.com, covering weekly HR Technology news and trends. She can be reached at Stacey.Harris@

Sierra-Cedar.com.

Endnotes

1 https://opportunity.businessroundtable.org/ourcommitment/

2 https://www.synergysky.com/blog/fake_meetings

3 https://www.sierra-cedar.com/hr-systems-survey/