“This virus is essentially malware aimed at the source code of humanity.” – Amy Webb, Quantitative Futurist

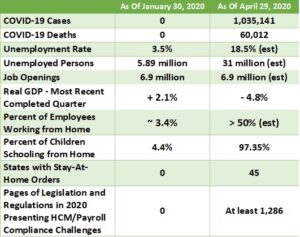

On the last day of January, 2020, the average HR Information Technology professional in America was probably upbeat, working within a thriving economy, challenged by projects designed to harness the latest HR technology innovations, and focused on typical HCM tasks, such as:

- helping HR customers to source and hire the best talent available, given that the country was experiencing the most challenging full-employment hiring market seen in 50+ years, with 3.5% unemployment,

- focusing on workforce analytics and perhaps even artificial intelligence to design and implement reporting “engines” that can produce more relevant, accurate and decisionable information for executive stakeholders, and

- with a relative “lull in the action” on the compliance front, turning their focus to improving the employee experience and HR service delivery mechanisms, in areas like employee and manager self-service and onboarding.

Fast forward exactly 90 days to the date this article is being penned. The US is in the grip of the most devastating pandemic in more than a century, with every aspect of society impacted.

Fig. 1 The US Coronavirus Pandemic “By the (HCM) Numbers”

This two-part article will examine the impact of the Coronavirus crisis on Human Capital Management. In Part I, the focus is on the left half of the crisis’s “V” – the impact on HCM of our descent to the bottom – the point at which things begin to turnaround. That left hand of the “V” includes new legislation compliance efforts, required systems updates, and accommodating workers who are adjusting to unprecedented levels of work disruption. Part II, in our next issue of WSR, will focus on the right side of the “V”. Entitled “The Morning After…,” it will examine the profound changes in working conditions we can expect when the US heads back to its employment “New Normal,” and how Human Capital Management professionals will be essential players taking part in solving the problems that this new normal presents.

Compliance First, Last and Always

Has it really been less than three months since HCM professionals were congratulating themselves for meeting last year’s compliance challenge – EEO-1 Component 2 Reporting – and looking forward to a nice, peaceful year focusing on more strategic objectives? After all, it’s a presidential election year and everyone knows that little legislation passes in an election year!

Then the Coronavirus crisis hit, and from March 18 through April 24, almost 1,500 pages of new laws, regulations, interim final rules and Q&A guidelines were issued by the Administration, the DOL, the IRS, the Federal Reserve Board of Governors, and virtually all 50 states.

Never in the history of Human Resource Information Technology, have so many new laws, rules, and programs impacting HR/Payroll systems become effective in so concentrated a period of time. One benefits professional was overheard to complain, “It’s like four ACA bills all became law at the same time, and instead of two years to implement them, we have 17 days.”

The Families First Coronavirus Response Act of 2020 (FFCRA)

On March 18, 2020, the President signed the FFCRA, a groundbreaking piece of legislation which, for the first time in US history, established a mandate for private sector employers to pay their full-time employees for sick leave and family/medical leave. The law went into effect on April 1, 2020. While these new mandatory PTO programs apply only to employers of 500 or fewer employees, only for leave for specific COVID or Coronavirus-related reasons, and at this point only to leave taken through December 31, 2020, it nevertheless left employers and their HCM professionals struggling with the compliance implications of the law and its implementing regulations:

- …how to design new pay or earnings codes, and limit pay and resulting tax credits to the maximum amounts prescribed by law,

- …how to determine the “cost of health insurance” around some rather byzantine follow-on guidelines issued by DOL (see below), and

- …how to coordinate multiple “layers” of entitlements which can be few or many, depending on an employer’s geography, federal contractor status, and other factors. In other words, when an employer pays an hour of FFCRA Emergency Paid Sick Leave, can that same hour serve to decrement available: corporate PTO? What about unpaid Family/Medical (’93 FMLA law) time? state-, county- or city-required sick, safe and/or family/medical leave? And then there’s Executive Order 13706 federal contractor mandated paid sick leave? And what about §45S paid family/medical leave? A few of these “conflict of entitlement” questions are answered by follow-on DOL guidance. Most are not.

The real complexities of both the FFCRA and the law that followed it just nine days later (The CARES Act; see below) were reserved for payroll managers and their technology support. And in a perverse turn of events, the DOL issued follow-on FFCRA guidance on April 1 which defined the 30-day good faith non-compliance grace period as having started on the law’s signature date (March 18) rather than its effective date, in effect giving employers just 17 days (until April 17) to comply with employees’ properly documented requests for statutory leave, or risk penalties.

The Coronavirus Aid, Relief and Economic Security (CARES) Act of 2020

On March 27, 2020, the President signed the CARES Act, the third in a sequence of laws that, combined with a follow-on piece of legislation intended to supplement funding in the Payroll Protection Program (the “Payroll Protection Program and Health Care Enhancements Act” signed on April 24) totaled in excess of $2.8 trillion in federal spending to address the impacts of the Pandemic.

The CARES Act rolled out several more financial programs to help employers keep their doors open during the health crisis, all of which are unprecedented, and have implications for HR/Payroll systems. These include:

-

- The Employee Retention Tax Credit. The ERTC is available to employers of any size (not just those with less than 500 employees like other Coronavirus financing programs), provided that they had conducted business in calendar year 2020 prior to the health crisis and (i.) they have had their business operations fully or partially suspended by government order, or (ii.) they experienced a same calendar quarter 2020-over-2019 reduction in gross receipts of at least 50%. In this case, the ERTC remains available to the employer until same calendar quarter 2020-over-2019 gross receipts comparisons recover to 80% or more.The ERTC provides employers with a 50% tax credit on the first $10,000 of wages per employee (to a maximum of $5,000), paid between March 13, 2020 and December 31, 2020. It is also available to §501(c)(3) not-for-profit organizations, but not to government entities.For employers of 100 employees or more, the ERTC can only be taken on wages paid to employees NOT working. For example, the employee may have been retained in lieu of layoff, or be working a reduced schedule imposed by the employer. For employers of less than 100 employees, the ERTC can be taken against ALL wages paid during the applicable period, subject to the limits indicated above. Note that the $5,000 tax credit limit per employee is for the entire period, not per quarter.

-

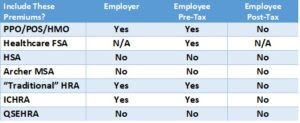

- The Paycheck Protection Program. As a “mega-financed” financial aid program aimed at small employers ($670 billion in loans, in two traunches so far), the “PPP” may have proven that the road to controversy is paved with good intention. The PPP is open to employers of fewer than 500 employees with one major exception: so-called “Sector 72” employers (those with NAICS Industry Codes beginning with “72” – generally hospitality companies like hotels and restaurants) may apply if they have more than 500 employees total but fewer than 500 employees per location or “store.” The program is open to §501(c)(3) not-for-profit organizations, §501(c)(19) veterans organizations, tribal businesses, sole proprietorships, independent contractors and the self-employed as well.The most attractive part of the PPP, and the aspect that made it so competitive for applicant employers, was the ability to have up to 100% of the loan proceeds “forgiven” – effectively, transformed from a loan to an outright grant.The first allotment of $349 billion was fully depleted within 13 days of the opening of the program, and a week later another $321 billion was allotted. The process by which loans were prioritized and approved by the commercial banks working the program has prompted intense competition, scrutiny, and rather vocal criticism, prompting some cynics to dub the program “The Anger Games” (I and II).The HCM implications for the hundreds of thousands of companies that were successful in obtaining loans under the PPP were, like those presented by the FFCRA, massive. Employers had to aggregate payroll costs for designated “base periods” to determine the principal amount for which they were eligible. These payroll calculations were not straightforward either: compensation in excess of $100,000 annualized per employee, as well as any paid leave under the FFCRA, had to be excluded. The calculation of the cost of employer-provided health insurance, which could be included in the base payroll figure, was not simple either (see Fig. 2).Once the employer received the good news that their PPP loan was approved and then received the proceeds, that’s when the challenges for HCM professionals really kicked in. Payroll costs for the 8-week period starting on the day the proceeds were received had to be tracked. Once again, employer cost of health insurance can be included, but FFCRA-mandated leave must be excluded.But wait, there’s more. Forgiveness starts at 100% of the proceeds but is then subject to a series of potential reductions, including a reduction if less than 75% of the proceeds are used to pay the employer’s payroll, reductions for each and every involuntary termination during the loan period (when compared to a base period specified in the regulations; this calculation is to use “FTEs” and at this writing we still await guidance on how those calculations are to be made), and reductions for cuts in pay of more than 25% to any employee earning under $100,000. To raise the complexity level to “almost-stupefying,” the regulations go on to explain how PPP loan recipients who qualify for forgiveness but then lose it due to headcount or pay reductions, can regain it by restoring staff and/or restoring salaries by June 30, 2020. The PPP is, after all is said and done, designed to be an employee retention program during the uncertain times of COVID.

- Deferred Payment of Employer OASDI Tax. As HCM and Payroll professionals know, calculation and remittance of Social Security taxes consists of four distinct pieces: the employer share of OASDI (6.2% of wages up to $137,700 in 2020), the employee share of the same, the employer share of Medicare tax (1.45% of wages under $200,000 and 2.35% of wages above $200,000, with no limit for 2020), and the employee share of the same. The CARES Act provides for deferred payment of just the employer share of OASDI, for all wages paid between March 27, 2020 and December 31, 2020. Employers of any headcount or revenue size can participate in this program. For a single employee earning in excess of the FICA limit during this timeframe, that represents a deferral of $8,537.40 in 2020 employer Social Security tax that would normally be due for deposit as the base wages are paid, so these amounts will add up!The deferred OASDI taxes become due to the IRS on the following schedule: 50% of the total deferred amount due for deposit by December 31, 2021, with the remaining 50% of the total deferred amount due by December 31, 2022.

The overall HCM impact of the CARES Act is profound by design: new reporting, new tax credit calculations, and new long-term recordkeeping for deferred taxes. For example, employers taking advantage of the OASDI tax deferral will be maintaining those records for as long as 33 months, to ensure that all tax deferral payments are made on time. Employers will need to consider whether they will still be with their current payroll provider and tax filing service (whether on-prem, SaaS or service bureau) for that full span of time, who is responsible for remittances after a change in provider during that time, etc. For employers using a Certified PEO, subsequent regulations clarify that these various tax credits belong to the worksite employer and not to the PEO despite any co-employment considerations. But to paraphrase an old, but effective, advertising slogan: “It’s December 30, 2021 and you’ve deferred employer payroll tax payments from 2020; do you know where your records are?”

Finally, the total amount of taxes being deferred, as well as tax credits aggregated under the FFCRA paid leaves (wages and employer health care costs) and the ERTC, combine into what could, for most employers, be a very large amount of money. How does the employer get that money? The IRS clarified that, since the point of all this legislation was to help employers not only with overall ongoing costs, but cashflow as well, employers “help themselves” to these credits; they don’t wait for the IRS to write them a check. Most mid-sized to large employers are either next-day or semi-weekly depositors of employment taxes, meaning that it’s never more than 3-4 days until the next EFTPS (Electronic Federal Tax Payment System) deposit is due from an employer to the IRS.

In a first-of-its-kind move, the IRS encourages employers to withhold from EFTPS deposits any amount they calculate they are due for aggregate tax credits for the period. Additionally, the IRS clarifies that those withholdings can come out of ANY tax the employer has due to the IRS for the pay period – even federal income tax withholding from employees’ paychecks.

Example: Acme Manufacturing owes a combined $50,000 in OASDI (e’e and e’r), Medicare (e’e and e’r) and FITW for the current pay period, and it is due for deposit in 2 days. They also calculate that the total tax credits to which they are entitled for this period – from Emergency Paid Sick Leave, Extended Paid Family/Medical Leave, and the Employee Retention Tax Credit – is $22,500. They simply remit $27,500 in their next deposit, rather than the $50,000 that would normally be due. No special permission or IRS form needed. This will ALL be reconciled on a heavily modified, new format Form 941 for the second quarter of 2020 (for which the IRS has already released draft forms and instructions.) And if by chance Acme were to calculate that their tax credits actually exceed their deposit amounts due for the current quarter, the IRS has released a new Form 7200 for employers to file to receive “prompt” (the promise is within two weeks) IRS checks for the difference.

Fig. 2 Calculating Employer Health Insurance Costs for FFCRA, ERTC & PPP

Source: IRS Guidance (Last Reviewed 28Apr2020), Q35-36: https://www.irs.gov/newsroom/covid-19-related-tax-credits-for-required-paid-leave-provided-by-small-and-midsize-businesses-faqs

Work-From-Home Challenges for Human Capital Management

Turning from compliance to the best practice issues facing HCM professionals, it isn’t hard to imagine that, within the first few weeks of the “shutdown” process, the same request was being made by thousands of CHROs and HR VPs to thousands of their HRIT/HCM colleagues: “My employees are now predominantly working from home, and just at a time when the risks to their health and well-being have never been greater. Can you help me keep in touch with them, assure myself that they remain healthy, and support them during this massive disruption?”

According to a survey of 550 US employers conducted from March 12 through March 16, 2020 by the Society for Human Resource Management, 67% of employers were taking steps to allow employees who don’t normally work from home, to do so. For this reason, Job One during the Pandemic, for most employers, would be to establish a regular cadence of communications with employees working from home.

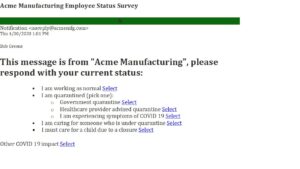

One best practice being seen throughout the HCM industry is a regular daily check-in alert, sent by an HR or Workforce Management system at the same time each work day, asking the employee to report their work situation. The short “pulse-like” survey would ask each employee to respond with their status based on choices like this:

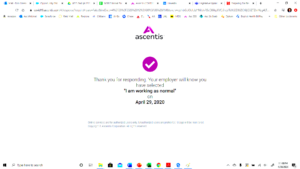

Upon responding by clicking one of the select links, the system can then record each employee’s status historically, each day, and return a confirming message to the employee…

…and the HR Director should be able to receive a report by status, so that they can follow up with each employee indicating a response other than “I am Working as Normal.” The alert should also be able to automatically redirect the employee to a Self-Service page to complete a Leave of Absence or Sick Pay online form, although most HR professionals will want to follow up directly with the employee to ensure they understand required documentation for the leave, length of approved leave based on the employee’s specific circumstances, and any return-to-work documentation the employer will require at the end of the leave.

Other Coronavirus HCM Best Practices

Employee Portal Updates: Employers will want to have regular updates for their employees throughout both the crisis and recovery, and a well-developed employee portal, front-ending employee and manager self-service tools, is the perfect “home base.”

In fact, best practice employers will want to update their landing pages with items of general COVID interest to employees: local openings, closings, and social distancing regulations, school year updates, and perhaps even updates around the IRS Economic Impact Payments. The estimated $560 billion in direct payments to taxpayers will result in 93.6% of all taxpayers receiving some amount of stimulus payment. While the details of this program are beyond the scope of this article, HR professionals know that pending payments of $1,200 to $3,400 are top of mind for their employees!

Even though employers are not part of the distribution process for these funds, there are many reasons why HR departments may want to proactively post information about them on their employee portals. For example, they can include clickable links to various IRS web pages, such as a link to Form 8822, for employees to change their address with the IRS, or to the “Get My Payment” page on www.irs.gov. Keeping employees informed on this topic will not only improve engagement and employment brand, but also potentially forestall calls to HR about a process in which employers are not involved.

Deployment of an Alumni Portal: It is certainly true that this health crisis has impacted each employer uniquely, and the need to terminate, layoff or furlough employees to keep a business in operation is unique to each employer as well. But where an organization is laying off more than about 15-20% of their staff, implementation of an alumni portal assumes increasing importance. This portal can offer a central location to which ex-employees can return, for various functions: changing their address for later communications, connecting with benefit carriers where benefits are continued for a period as part of a severance package, and even downloading needed employee information returns at a later date (Forms 1095-c, W-2).

And if, as the optimists among us believe, the recovery will be dramatic and quick, an alumni portal represents an efficient “corralling” effort to speed communication with employees whom a company may wish to call back.

In Part II of this series, WSR will focus on HRIT’s contributions to each organization’s recovery: from steps that must be taken to ensure general wellness in those returning to work, to calculating and defending forgiveness amounts under the PPP, or to necessary changes to Performance Management and Succession Planning processes, the “new normal” is going to require flexibility, ingenuity, and more than a little bit of patience.